- Clark.com Biweekly Newsletter (Mondays and Thursdays)

- Posts

- Clark Biweekly 12 4 25

Clark Biweekly 12 4 25

Advertisement

💵 Today’s Top Stories

Buy an extra-large griddle with a warming tray just in time for holiday cooking, a throwback Lite-Brite combo pack, an LED-light snowman family and more at Costco right now. Read more. |

Clark is shocked by how much money that 50% of parents with adult children give to them each month. What’s more, parents are sacrificing their own financial security to do so. Read more. |

Doing a lot of online shopping? You probably expect to see a few packages at your doorstep. But be wary of items you didn’t order. Read more. |

Follow Clark’s No. 1 rule to rack up instant savings every time you buy batteries. Team Clark unveils the cheapest sellers and the best places to find deals. Read more. |

December is bringing some of the most lucrative credit card sign-up bonuses we've seen all year. We reveal the top offers this month, including a bonus that could net you as high as 175,000 points for your next big trip. Read more. |

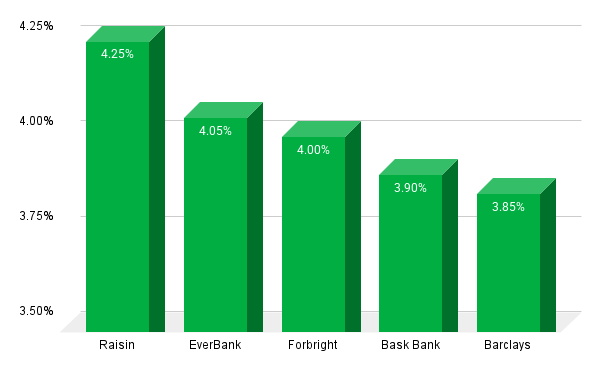

💵 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of December 4, 2025.

🛒 Beware of ‘Surveillance’ Pricing This Holiday Season

If you’re what Clark calls a “convenience” shopper – price agnostic, not going to put effort toward searching for the best deal, not as intent on saving money – you probably won’t care, at least for now.

But if you’re like Clark, and you hunt for the best deal every chance you get, be wary of the new game of “surveillance pricing.”

We’re in the early innings. And companies that are too obvious, or flat-out admit plans to use it publicly (see: Delta earlier this year) get major blowback.

But the technology now exists to take advantage of you, by charging you more.

“This capability is out there, fully available, and developed. There are going to be players in travel, especially, but also in retail, that will use these tools to offer discriminatory pricing based on what they think your impulses are,” Clark says.

“The deep data that’s available now on each and every one of us is such that companies have the ability now for individual pricing.”

To counter the trend, Clark recommends using some level of browser privacy/anonymity when shopping online (examples: a VPN, incognito tab, or privacy-focused browser like duckduckgo.com). Or, at the least, compare prices when logged into a loyalty account vs. when visiting the site as a guest.

Clark also recommends using pricing tools, particularly those that offer data on historic pricing trends. He called out CamelCamelCamel as an Amazon shopping companion, for example.

The introduction of these price points should be slow at first, and may be limited to a few industries. But get in the habit of shopping anonymously. Because companies can’t price discriminate against you if they don’t know who you are.

📊 Stat of the Day

🛍️ $11.8 billion: The record amount Americans spent on Black Friday, just online. That’s up almost 10% from last year. Americans could spend a record $253.4 billion this holiday season.

💰️ Deal Alert: Today’s Top Deals

🎙️ Podcast

With headlines full of AI and job insecurity, Clark warns that this constant change is your fair warning – you can't afford to be a "sitting duck" in your career. Learn how a commitment to continuous education, even free programs offered by your employer, can be your best defense against being run over by technological change. Also, Clark dives into a difficult conversation many parents are having: nearly half of US parents are helping their adult children financially, spending an average of almost $20,000 per year – and most say it's hurting their own financial well-being and postponing retirement. While help during a tough patch is reasonable, Clark is highly concerned. Hear Clark's advice on when to establish clear financial boundaries and why you need the courage to say no so you can live the life you want and protect your own retirement.

☎️ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.

Advertisement

Did You Enjoy Today’s Newsletter?Let us know what you think so we can better serve you! |